ČSOB needed to innovate its insurance fraud detection process, increase efficiency, reduce false positives, and protect against dynamically evolving fraudulent activities.

Automated insurance fraud detection for greater efficiency

Client NameČSOB Pojišťovna

Client CountryCzech Republic

- Client typeEnterprise

- IndustryFinancial Services, Markets & Insurance

- Application areasData & Analytics / Business Intelligence, Legal, Compliance & Risk, Strategy, Planning & Decision-Making

- AI technologiesAI Agents & Task Orchestration, Forecasting & Time Series Analysis, Machine Learning

- Business impactsOperational Efficiency & Cost Savings, Risk Reduction & Compliance

- Data typesStructured Tabular Data, Time Series

- Delivery modelsProduct / Licensed Software, Service / Subscription

- DeploymentsCloud

- Key capabilitiesAnomaly, Risk & Fraud Detection, Decision Support & Augmented Analytics

- Project stagesInitial Production Deployment

- Solution formsAPI / Micro-service Interface, Automated Backend Process, Web Portal / Dashboard

Solution Description

Problem description

Solution

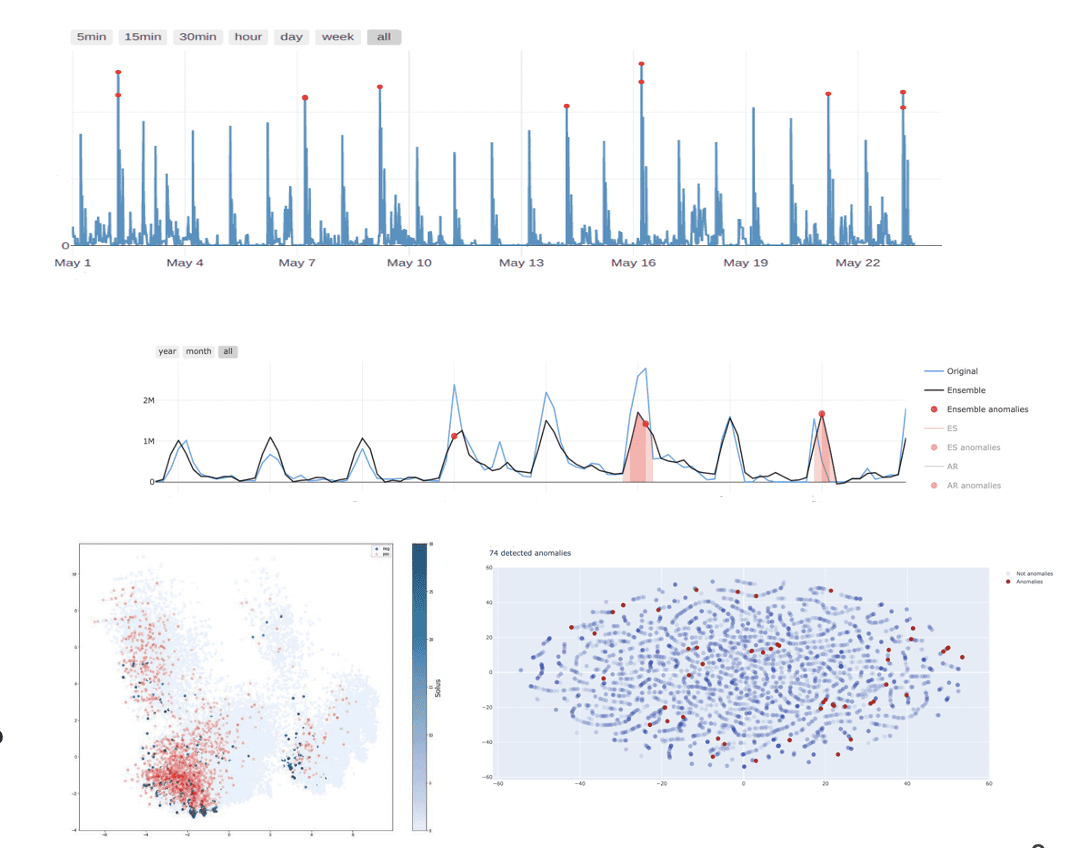

We implemented machine learning using our ADF framework for fraud detection. This process included historical data analysis with algorithms to identify key anomalies and clusters.

Main Users of the Solution

Data analysts, fraud specialists, risk managers.

Project timeframe (months)

6

Technologies used

ADF framework, machine learning algorithms

Additional services

- Annotation / synthetic data / dataset extension

- AI model selection and customisation

- Ongoing maintenance and retraining of the model

Use of Personal / Regulated Data

Implementation

Project Owner on the Client's Side

Head of Innovation / Digital Transformation

Participation on the Client's Side

- Domain / process experts

- Project and change management

- End users

Form of Supplier Involvement

Joint implementation with the client

Operation and Maintenance

Operational Model

Joint management with the internal team and the supplier.

Needed Competencies on the Client's Side

Data and analytics specialists, fraud detection experts.

Other Resources or Infrastructure

Vendor support; cloud infrastructure.

Impact and Results

Qualitative Benefits

Increased fraud detection capability, higher process efficiency, reduced false positives.

Quantitative Results

60% reduction in false positives, improved fraud detection efficiency.

Client Feedback

“Innovation in fraud detection has allowed us to manage fraud more effectively and focus our resources on relevant cases.”

Lessons Learned and Recommendations

Key Success Factors

Close collaboration with client data experts, adaptability of the AI framework.

Biggest Challenges

Reduction of false positives without compromising real fraud detection.

Recommendation for Others

Integrate historical data and advanced algorithms to strengthen fraud detection in your portfolio.

Promotion

Demo / Public Resources

- CompanyBlindspot Solutions

- ContactMichaela Peterková

- Emailmichaela.peterkova@adastragrp.com

- Websitehttps://blindspot.ai

- AddressKarolinská 706/3, 186 00 Praha